🏦 Financing the Energy Transition. Part 2

How to boost investements into new green infrastructure.

Last week in Financing the Energy Transition - Part 1, we saw that financing renewable infrastructure was a key piece of the energy transition puzzle. With most of the costs of renewable assets being upfront, developers and investors must find ways to secure the capital as cheaply as possible, to build the energy system of tomorrow.

Today in Seagnal, a newsletter at the intersection of technology and sustainability, we’ll look at the tools that project developers have used to reduce the cost of capital of new green infrastructure.

Getting the ball rolling

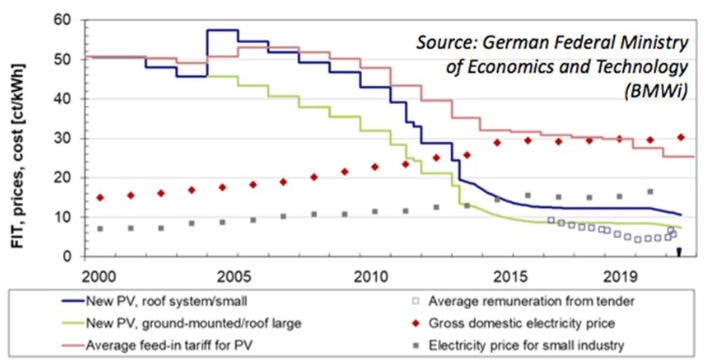

In the early days of renewable energy development, governments made it straightforward for developers. They offered substantial subsidies, mainly in the form of feed-in tariffs (FiTs). FiTs guarantee a fixed purchase price, significantly above market rates, for green electricity over long periods (e.g. 20 years).

Germany led the way with its Renewable Energy Sources Act (EEG), introduced in 2000. By 2014, this legislation, and the associated FiTs, had helped Germany achieve a renewable energy share of about 27% of its electricity consumption, up from 6% in 2000.

However, this approach did not encourage competition and was expensive for governments and consumers. Greece which also introduced generous FiTs in the mid-2000’s had to retroactively revise its FiT policies, and impose cuts on existing contracts to stabilize the financial system.

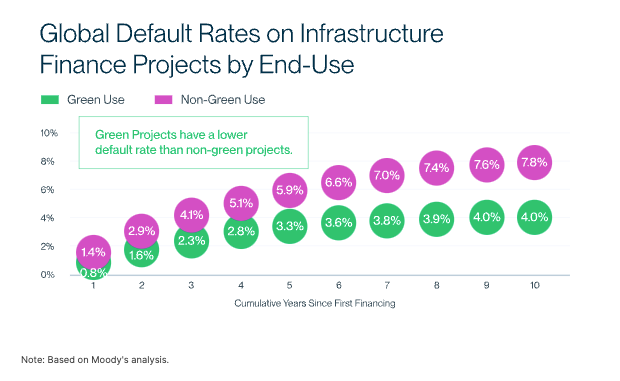

The initial roll-out of renewables was supported by government incentives and guaranteed revenues (eg. FiTs). These subsidies reduced the risks of projects and therefore their cost of capital.

Lower default rates in green infrastructure project show reduced risks, from SVB, data from Moody’s.

Competition reduces cost

The United States, instead of implementing FiTs, chose to use Investment Tax Credits (ITCs). ITCs allowed project owners to deduct a percentage of their investment costs from their federal tax liability paid out in the first year of operation. This effectively incentivized entities with large tax liabilities, such as corporations and investment funds, to invest in renewable projects without requiring government guarantees on revenues.

As the costs of renewable energy technologies began to fall, Europe also shifted towards market-based mechanisms. They introduced tenders, where renewable energy developers submit competitive bids to supply electricity at a fixed price, with purchase contracts awarded to the lowest bidders. This approach fostered competition and drove down costs, making renewable energy more affordable for governments and consumers.

German Feed-in-Tarrifs (FiT) prices from 2000 to 2020, data from BMWi.

The role of the private sector in financing the transition.

In parallel to tenders set by governments, private companies have also sought ways to meet their environmental goals. Power Purchase Agreements (PPAs) between private companies, like Microsoft, and project developers have become a common way to fund renewable projects.

PPAs are often bundled with Guarantees of Origin (GO), certificates that verify the energy's renewable source. Developers can sell these GOs to corporations or electricity providers, either bundled with the PPA or separately. Corporations or utilities can then use GOs to reduce their carbon footprint or sell green electricity to end consumers.

Currently, PPAs and GOs are accounted for on a yearly basis, but there is a push to enforce hour-by-hour matching regulations. Today, a green energy provider in Germany can claim to sell 100% green electricity by signing PPAs with Spanish solar farm developers, even though the energy is produced only when the sun is shining in Spain. Hour-by-hour matching could finance more expensive green energy projects, such as integrating more batteries with solar and wind installations, ensuring a more consistent and reliable supply of renewable energy.

The future of renewables financing

As we have seen, the evolution of renewable energy financing has seen significant shifts from government-led subsidies to market-based mechanisms and corporate initiatives.

Today, tenders, ITCs, and PPAs play a crucial role in funding renewable projects. These mechanisms foster competition and drive down costs while allowing corporations to directly support and benefit from renewable energy investments.

Looking ahead, the push towards more precise green energy accounting, such as hour-by-hour matching, could drive further innovations and investments. As renewable energy becomes a larger share of our energy mix, substantial investments in grid infrastructure will be essential too. Upgrading and expanding the grid to handle the intermittent nature of renewable sources and integrating smart grid technologies will be crucial to maintaining stability and reliability.

🔗 - Check these out

Want to dig deeper? Check these out:

Interestingly Feed In Tarriffs in Europe also allowed China to dominate the renewables manufacturing supply chain, as we saw in Manufacturing Wars.

From Geneva 🇨🇭,

Jean

PS: Got tips to improve the newsletter or topics you would like me to explore? Reply to this email with your suggestions!