🏦 Financing the Energy Transition. Part 1

Capital costs, LCOE, and financing costs explained simply.

Renewables, such as wind and solar farms, have been cheaper than fossil fuels to produce electricity for the last 5-10 years. So why don't we see more of them? Beyond issues like permitting, grid capacity, and logistics; one of the challenges is financing this energy transition.

In this issue of Seagnal, a newsletter at the intersection of Sustainability and Technology, we will dive into the cost structure of renewables to understand why financing is so important. In the second part, next week, we will explore the solutions to overcome the financial hurdles of the energy transition.

Levelised Cost of Electricity (LCOE)

Renewables are great: they don’t emit any greenhouse gases (GHG) to produce electricity and their inputs—wind and sunlight—are free. However, they require quite a bit of capital to build: equipment and labor costs, but also grid connections, earthworks, etc. So how can we say they are cheaper?

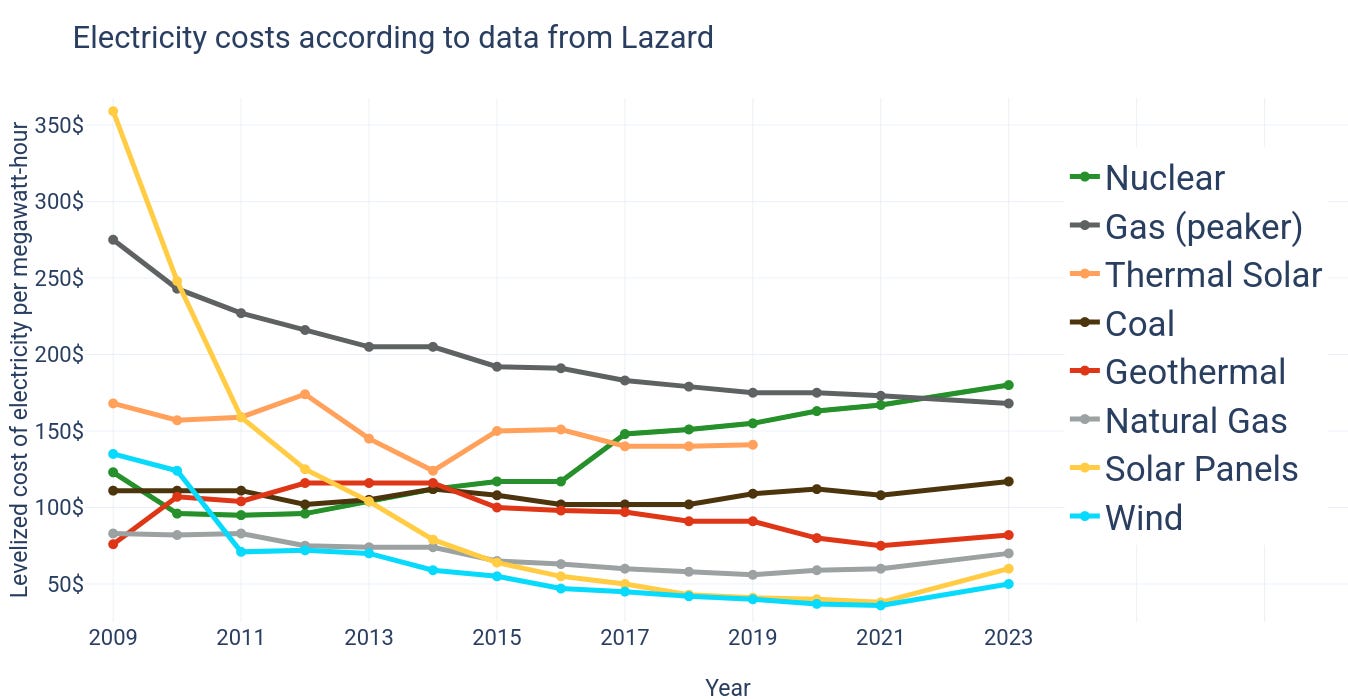

To compare the true costs1 of different electricity sources, we use the Levelised Cost of Electricity (LCOE). The LCOE represents the net present cost of electricity generation over the asset’s lifetime. Looking at the latest LCOE figures for popular energy sources in 2023, we see that wind and solar are indeed the cheapest:

Average unsubsidized electricity generation LCOE by source, data from Lazard, image from Wikipedia.

Why then, do so many developing countries still build coal plants if the LCOE of solar is much cheaper? Partly because the wind and sun don’t always shine, but also because the LCOE shown above measures the cost over the lifetime of the asset.

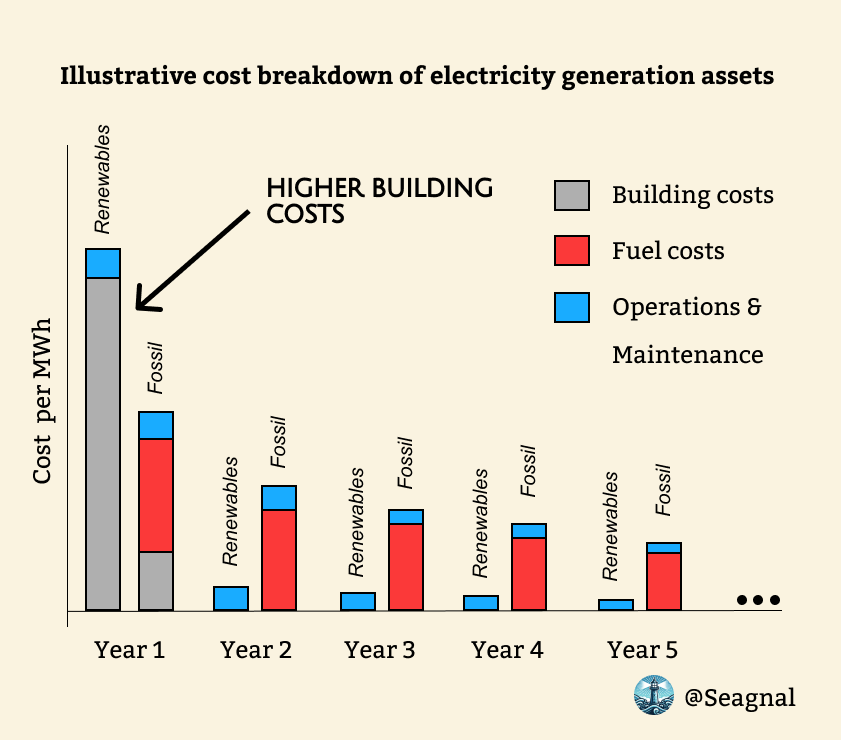

While in the long run, renewables might be cheaper, they require a lot of spending upfront. On the other hand, fossil-based electricity generation is capital light but has higher ongoing operation costs (for fuel costs). Below is a sample cost breakdown over the initial years of renewables vs fossil-based electricity generation:

Sample cost breakdown/year of fossil vs renewable-based electricity generation.

A coal plant might cost you more over its lifetime, but will cost you less in Year 1!

Why financing matters a lot for the energy transition

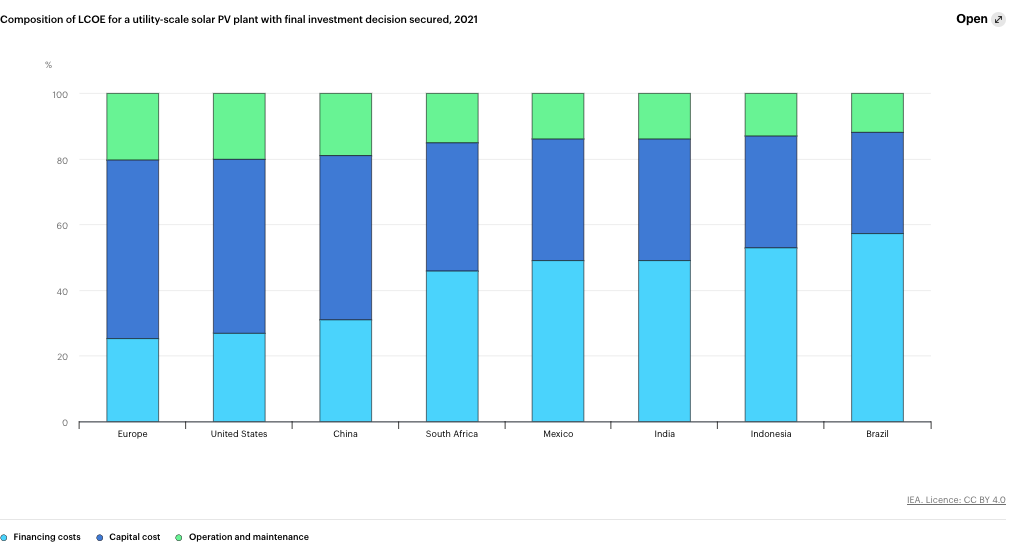

Previously we talked about the building costs, which were higher for renewables-based electricity. But in the real world, you also need to factor in the financing costs (the cost of borrowing the money) for the building costs!

Financing costs are represented in the LCOE we used to compare the cost of different energy types. In fact, it is astonishing how much the financing cost makes up of the total LCOE:

Composition of LCOE for a utility-scale solar PV plant with final investment decision secured 2021, light blue financing cost, dark blue capital cost, green operations and maintenance (over the life of the asset), source IEA, CC BY 4.0.

In the graph above, comparing the LCOE of a utility-scale solar plant, we can see that financing costs (light blue) vary greatly — from ~25% in Europe to more than 50% in India (2021 data). Financing costs matter a lot for renewables!

This variability is influenced by factors like country-specific interest rates, financial market maturity, and perceived investment risks. These all affect the cost of capital and ultimately the feasibility of renewable energy projects. That’s why, in developing countries like India, where interest rates (and default rates) are higher, it can be tempting to build coal plants today because they seem cheaper in the short run.

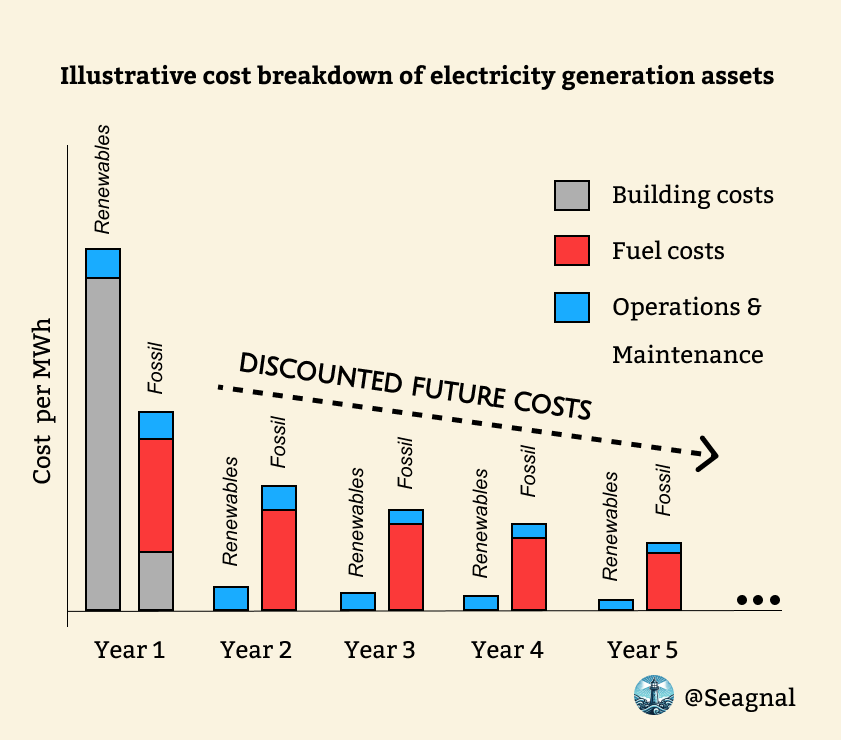

Finally, when interest rates are higher, they don’t only impact financing cost, but also the discount rates of the future costs. This means interest rates are a double whammy for renewables: they make their financing cost more expensive, but also discount the future costs of their rivals: fossil-based electricity generation!

Sample cost breakdown in initial years of fossil vs renewable-based electricity generation, with discounted future costs.

Summing it up

While wind and solar are cheaper and continue to gain market share, we still have many challenges to solve in our quest for net-zero electricity generation. One of these challenges is financing the energy transition.

Today, we explored the concept of Levelized Cost of Electricity (LCOE), seeing that financing costs can constitute up to 50% of a solar farm project (in 2021, more now!). These financing costs vary across countries, with interest rates increasing both financing costs and the discount rates of future costs (favoring fossil).

This highlights the importance of coming up with financial solutions, that work both in developed and developing countries. Next week, in the second part of this article on financing the energy transition, we will explore solutions we are currently using to finance the energy transition.

🔗 - Check these out

Want to dig deeper? Check these out:

Explore LCOE Sensitivity to Cost of Capital on page 13 of Lazard’s 2024 LCOE report.

From Geneva 🇨🇭,

Jean

PS: Got tips to improve the newsletter or topics you would like me to explore? Reply to this email with your suggestions!

Comparing the different electricity sources in terms of costs is only one side of the equation, price being the other. Electricity prices fluctuate a lot and renewable sources aren’t dispatchable (ie. only produced at certain times).