📊 - China’s dominance of clean energy supply chains

Combating climate change and making the energy transition happen require a war-like manufacturing effort. We need to manufacture, ship and install more solar panels, wind turbines, and batteries each year for the next couple of decades.

But so far, one country is doing most of the heavy lifting, manufacturing the critical technology needed to secure a clean and plentiful future.

In this edition of Seagnal, a newsletter at the intersection of technology and sustainability, we will explore China's rise from having no share in global solar manufacturing capacity in 2001 (0%) to holding 50% in 2011 and 75% in 2021. Additionally, we will examine the broader impacts on the renewable manufacturing sector and the geopolitical tensions this dominance has sparked.

Solar photovoltaics (PV) demand and manufacturing capacity by country 2011 vs 2021, Solar PV Global Supply Chains, International Energy Agency (IEA).

A long-term bet

Towards the end of the 20th century, Deng Xiaoping's major economic reforms led to the emergence of China as a global manufacturing hub in sectors such as textiles, electronics, and heavy industries like steel.

But with growing energy needs, China was struggling to secure new energy sources. China began importing oil in 1993 and became the world’s second-largest oil importer by 2003, trailing only the USA. Its reliance on coal-fired power generation was increasing pressure from the public about air pollution.

Amidst these tensions, an ambitious bet was taken by Hu Jintao, Xi Jinping’s predecessor: shifting its manufacturing powerhouse focus from clothing and electronics to solar, wind and batteries.

PV manufacturing production by country, China Focus, Solar Energy in China: The Past, Present, and Future, Feb ‘21

China was late to the race, opening its first photovoltaics (PV) cell manufacturing line in 2002, but gained traction quickly by exporting most of its production abroad. Europe and particularly Germany were heavily incentivizing solar energy generation through feed-in tariffs. These tariffs, guaranteeing above market purchase price of electricity coming from renewable energy sources, drove up the demand for renewable hardware.

In the 2000s, it proved more cost-effective for China to export its PV modules, while domestically prioritizing the development of new coal power plants, hydroelectric dams, and wind farms.

An era of subsidies

In 2008, the financial crisis hit PV manufacturers globally, with a sharp decline in demand and increasingly difficult access to capital. But, looking at the PV manufacturing production by country graph above ☝️, China’s share of global PV manufacturing exploded from 2008 to 2011, while all other countries experienced a stark decline. Why?

The West’s answer to the 2008 financial crisis was focused on stabilizing the financial sector, along with some stimulus programs (around 1% of GDP for Europe). China, which had a healthier financial system at the time, went all in on a huge stimulus program (around 13% of their GDP). Renewable manufacturing, central to Hu Jintao’s strategy, benefited heavily from the stimulus: in one province alone, the PV industry received more than 1 billion USD in bank credits.

This strategic divergence remains relevant today, with EU's President Ursula von der Leyen mentioning in her 2023 State of the Union Address (about artificially low Chinese EV prices):

”We have not forgotten how China’s unfair trade practices affected our solar industry. Many young businesses were pushed out by heavily subsidized Chinese competitors.”

The government support in the financial crisis of 2008 allowed the Chinese industry to weather the storm. Today, it is still benefiting from government support for cheap land for solar panel factories and low interest rates.

Global dominance

While the government’s role in the growth of its renewable manufacturing industry is evident, the sector also has many advantages over its competitors:

Lower interest rates (US interest rates 5.5% vs China interest rates 3.45%).

Cheaper electricity prices (US and China industrial electricity prices at 8 cts/kWh vs 20 cts/kWh for Germany).

Cheap labor (let’s not forget Uyghur forced labor issues).

PV module production costs per country in 2022, Solar PV Global Supply Chains, IEA.

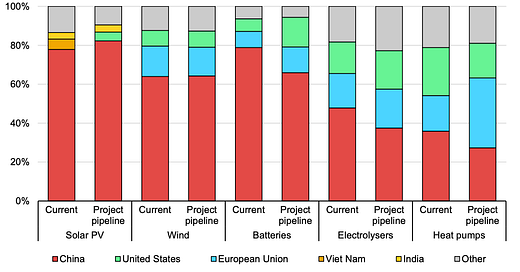

The chasm between China and the rest of the world is especially apparent in the solar industry but extends to other sectors of renewable manufacturing as well, such as wind, and batteries.

Current and announced clean energy manufacturing capacity by location, from the IEA State of Clean Technology Manufacturing November ‘23

Emerging competition

To summarise, we have seen that renewable energy manufacturing is a core part of China’s global manufacturing hub strategy. Thanks to government support and structural advantages, China has been able to dominate the market and provide the world with solar modules cheaper than fences.

While this cost reduction is beneficial for us all, such a production monopoly of these critical technologies is worrisome.

Since COVID, there has been a movement toward reshoring, with nations aiming to decrease their dependence on imports. The IRA, partly dedicated to boosting USA production of renewable energy on its territory, gives nearly $400 billion in tax credits and subsidies for low-emission energy production.

Yet, recently, Treasury Secretary Yellen raised concerns that despite the IRA, China could flood the US market: “We have raised overcapacity in previous discussions with China, and I plan to make it a key issue in discussions during my next trip there”.

As we navigate these geopolitical and economic tensions, strategic policy will be essential to balance competition with collaboration in the renewable energy sector.

🔗 - Check these out

Explore the history of semiconductor manufacturing and its similarities to the renewable manufacturing trade wars in Chips War, a great book by Chris Miller.

Discover the manufacturing steps of photovoltaics (PV) through this comprehensive online textbook developed by UNSW.

Bravo, Jean ! Une fois de plus article très intéressant et d'actualité. En France , nous avions 3 fabriques de panneaux photovoltaïque. Il n'en reste plus qu'une, la précédente venant de fermer très récemment. Manque de financements et d'aides de l'Etat., face à la concurrence chinoise de coûts plus bas. On espère que la dernière tiendra le coup ! Apparemment cette industrie manque d'une réelle motivation des investisseurs et de l'Etat.

Good short podcast with a different viewpoint on China's dominance of renewable energy supply chain: https://open.spotify.com/episode/338vNQTyZvkrIwcnKyF9ct?si=7b3a7236ca1e455d